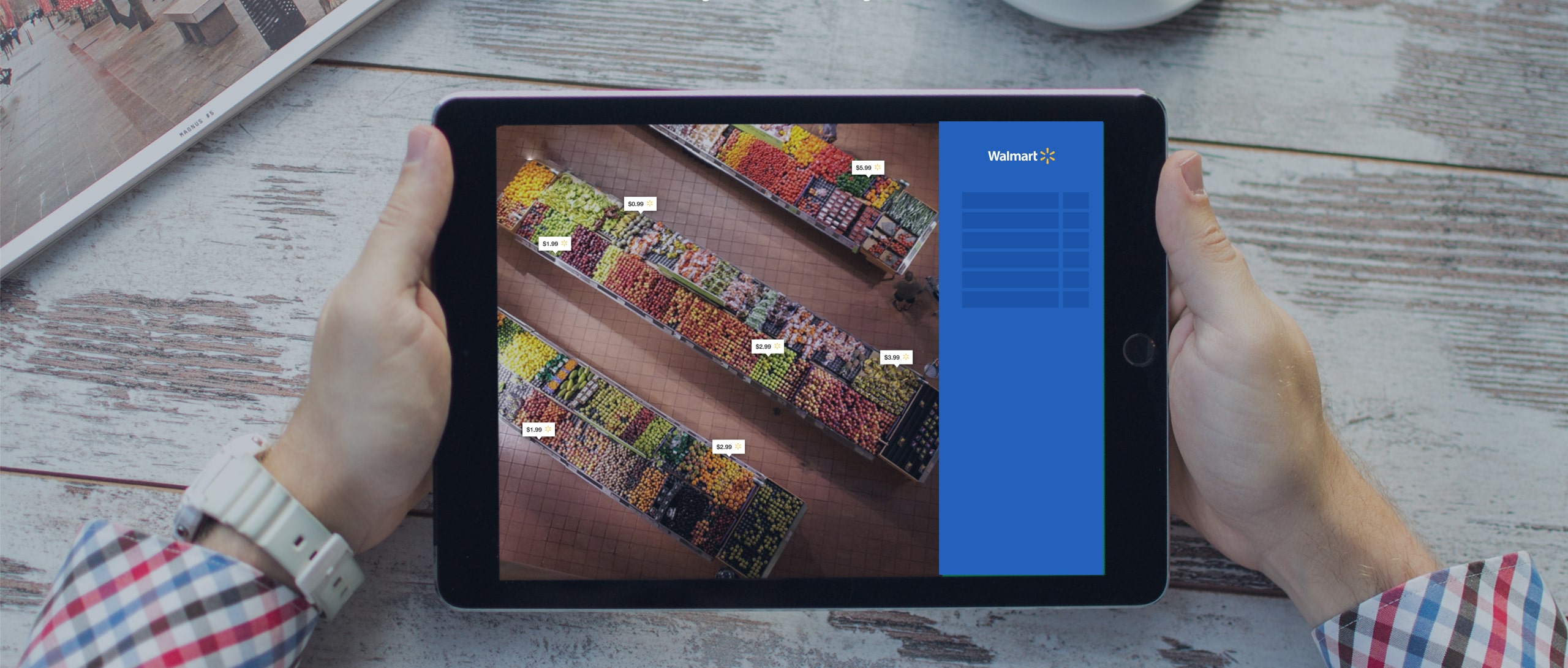

Walmart

Dynamic retail pricing

Overview

This UX case study provides a comprehensive walkthrough of my work for Walmart, detailing how I helped enhance their internal B2B pricing management software that employees rely on to analyze, develop, and execute successful pricing strategies.

Services

Research, Discovery, User Interviews, UX Design, Mentoring

Categories

Retail Pricing | Web Application | B2B

In this case study I have omitted confidential information to comply with my non-disclosure agreement. The information in this project is my own and does not necessarily reflect views or plans of Walmart.

two work streams

User Research

I designed, planned, and executed a four-week discovery research to learn about existing pricing software and validate design concepts through research findings

Guidance & Mentorship

I learned, gathered, and analyzed information about company pricing tools, deeply familiarized myself with the daily UX challenges both UXers and BPO owners deal with in order to build a strong foundation for UX recommendations.

Research and discovery

I conducted a four-week discovery research to help with learning about existing pricing software by talking to users and validating design concepts through their feedback.

research

Methodology

• Interviewed 8 users (Sr. Managers, Planners, and Buyers)

• Designed discovery questions to learn about behaviors and attitudes around the existing analytics tools

• Conducted A/B testing with two separate designs to gain better insight

• Gathered and analyzed discovery findings about participants’ experiences

• Provided UX recommendations based on research findings

study

objectives

• How did users describe their process in the software at that time?

• What were the biggest pain points? What were the key business outcomes they used the software to accomplish?

• How much time did they spend on average in creating, evaluating, and approving pricing plans?

• When shown one wireframe for how new pricing worked, what did they like about it?

• What would they improve? Did they currently look or expect to see different data than the previous solution?

research

findings

Accuracy of projections

Participants stated that overall, the existing pricing tool is a straightforward system to use and is the least painful application from an ease of use perspective. However, they indicated that the system often provides them with predictions that seem inaccurate, leading them to manually run numbers and calculations using Excel sheets. As a result, they prefer not to rely solely on the tool.

Meaningful data and how it’s displayed

• Participants indicated three data points they found most useful to perform their job and considered others as ‘less important.’

• The majority of participants preferred to have data presented side by side.

• Most participants mentioned that they would take action on the pricing plan level information nine out of ten times and would not delve into the details.

• A few participants found it helpful to have status information on the pricing plan.